Appeals

Property owners who are dissatisfied with their assessment may appeal their valuations through an Informal Appeal (Boards of Equalization) or a Formal Appeal (Abatement). Property owner is responsible to provide information to justify the requested appeal.

Informal Appeal (Boards of Equalization)

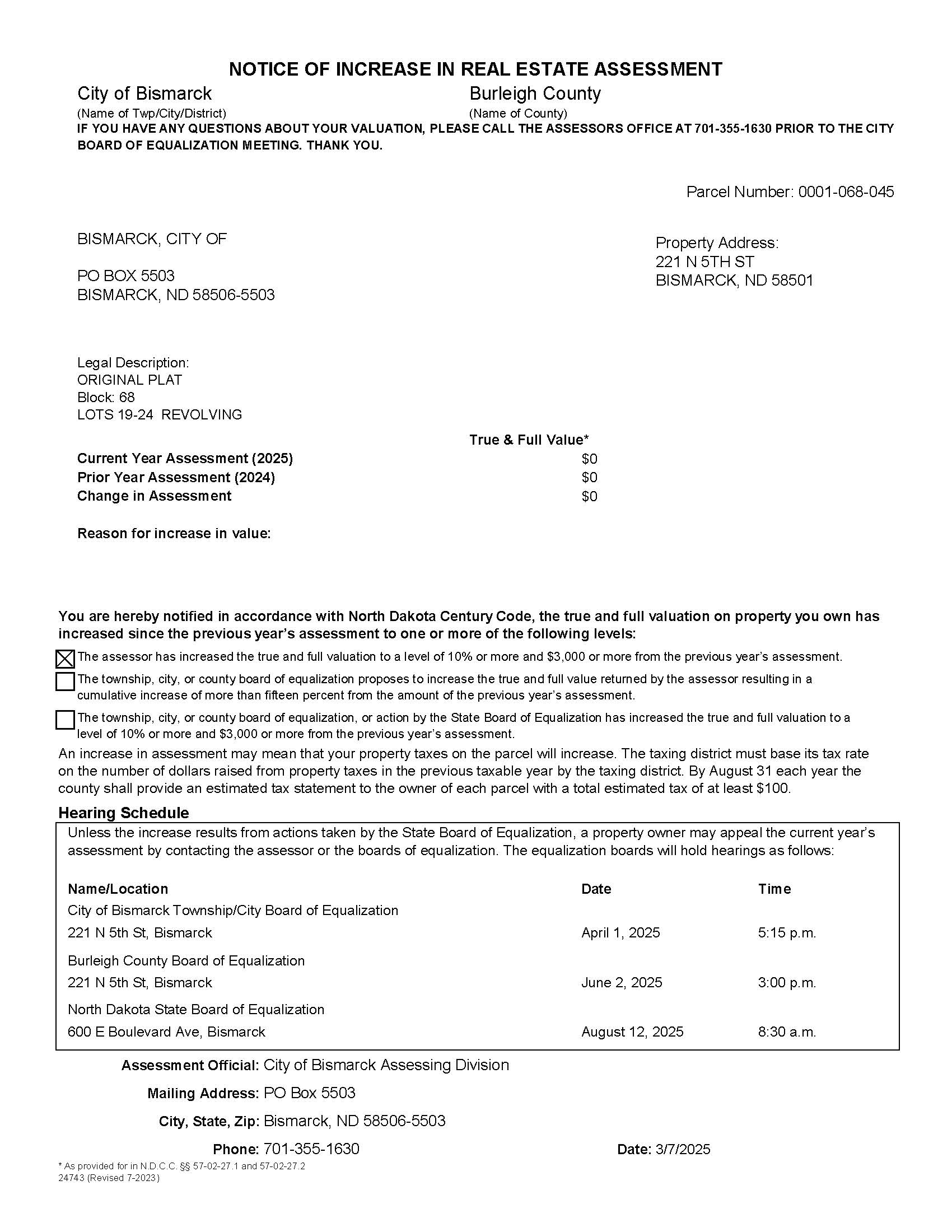

Property owners may present an appeal of valuation to the Boards of Equalization before the current year value is certified by those Boards. The meeting dates for the Boards of Equalization are as follows:

- City Board of Equalization – Within the first 15 days of April

- County Board of Equalization - Within the first 10 days of June

- State Board of Equalization - Second Tuesday in August

In order to appear before the State Board of Equalization, the property owner must have appeared before both the City and County Boards of Equalization. Appeals can be made to the County without appearing before the City Board of Equalization, however, the applicant will then not be allowed to further present an appeal to the State Board of Equalization.

Formal Appeal (Abatement)

The formal appeal may be made after a value has been finalized or certified by the Boards of Equalization, also known as an abatement.

An abatement must be filed no later than November 1st of the year following the year the property tax becomes delinquent.

Example:

2020 Assessment must be filed before November 1, 2022

2021 Assessment must be filed before November 1, 2023

2022 Assessment must be filed before November 1, 2024

The City or County will send a notice of hearing to the applicant within 10 days of receipt of the application. Upon submission of application for abatement, the property owner must consent to an inspection by the City Assessing Division. The date of the hearing in front of the City Commissioners must be within 60 days of the notice of hearing. Upon Approval, City Commission forwards a recommendation to the County Commission. After the County Commission action, an appeal can then be forwarded to the respective District Court.

You may access property information on this site through the property search. For additional information, or questions about your value, please call or email our office. Our staff will answer any questions you may have.

Contact Us

Assessing

Physical Address

221 N 5th St.

Bismarck, ND 58501

Mailing Address

P.O. Box 5503

Bismarck, ND 58506

Phone: 701-355-1630